The biggest business mergers of all time

The most colossal corporate couplings ever

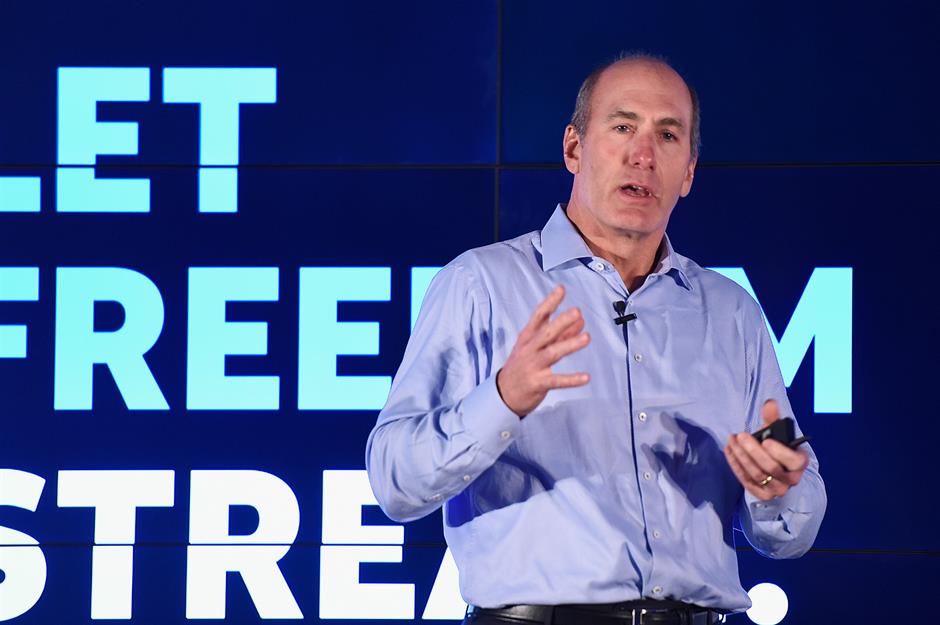

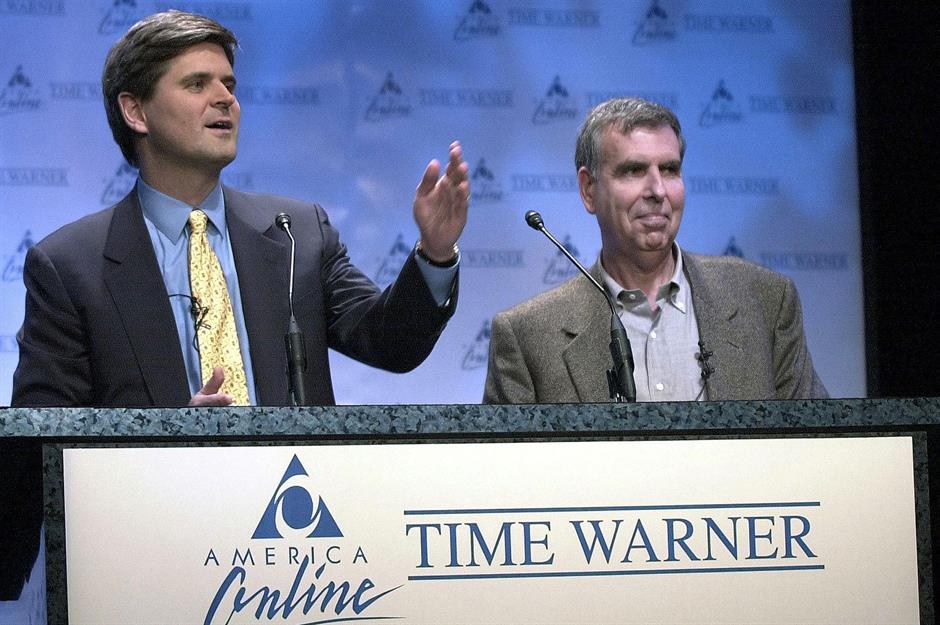

Ever since the East India and New East India Companies merged back in 1708, major companies have been joining forces to cut costs and increase market share. This year AT&T and Time Warner joined forces to the tune of $100 billion (£78.5bn), a move that risks putting AT&T into "terrifying" debt. But AT&T's former Chief Strategy Officer John Stankey (pictured), now CEO of WarnerMedia, will be hoping that with risk comes reward as the company seeks to reshape the media landscape. Read on as we reveal the 30 most costly corporate amalgamations of all time, adjusted for inflation.

30. InBev and Anheuser-Busch in 2008: $60.51 (£45.33bn)

29. Takeda Pharmaceutical & Shire in 2018: $62 billion (£46.45bn)

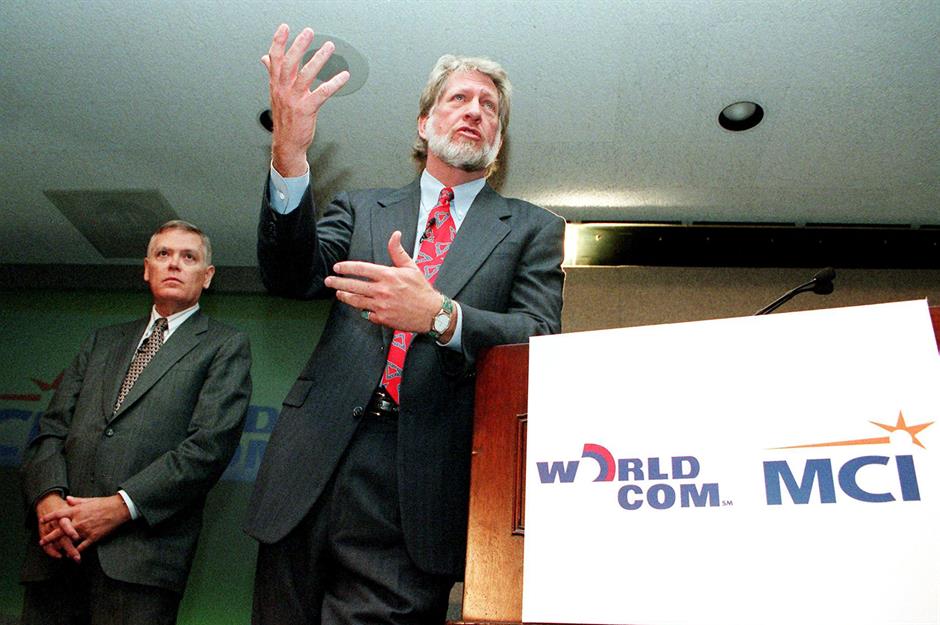

28. Worldcom & MCI Communications in 1997: $65.56 billion (£49.11bn)

27. Dell & EMC Corporation in 2015: $70.82 billion (£53.03bn)

26. Qwest Communications & US WEST in 1999: $72.19 billion (£54.08bn)

25. Disney & 20th Century Fox in 2019: $71.3 billion (£56.1bn)

24. Royal Dutch Shell & BG Group in 2015: $74 billion (£55.43bn)

23. Actavis & Allergan in 2015: $74.52 billion (£55.64bn)

22. J. P. Morgan Chase & Bank One Corporation in 2004: $78.25 billion (£58.63bn)

21. Pfizer & Wyeth in 2009: $79.41 billion (£59.50bn)

20. BP & Amoco in 1998: $81.47 billion (£61.04bn)

19. Bell Atlantic & GTE in 1998: $82.02 billion (£61.45bn)

18. Charter Communications & Time Warner Cable in 2015: $83.19 billion (£62.63bn)

17. Pfizer & Pharmacia Corporation in 2002: $83.56 billion (£62.61bn)

Before it absorbed Wyeth, Pfizer, which is no stranger to mega-mergers and acquisitions, paid $60 billion (£44.96bn) to amalgamate with Pharmacia Corporation, partly to secure full rights to the painkilling drug Celebrex.

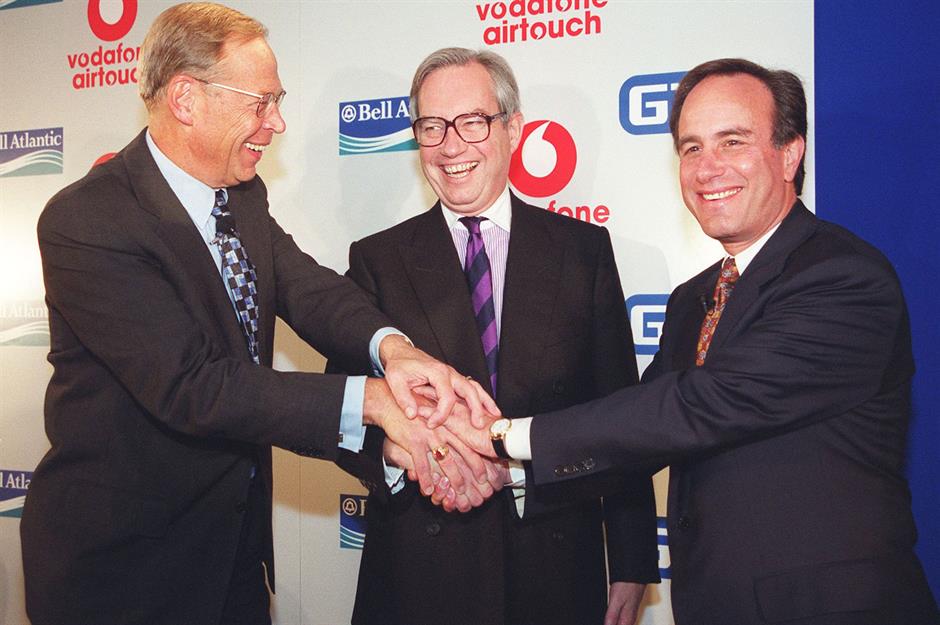

16. Vodafone Group & AirTouch Communications in 1999: $90.23 billion (£67.61bn)

15. SBC Communications & Ameritech Corporation in 1999: $94.74 billion (£70.73bn)

14. Royal Dutch Petroleum & Shell Transport & Trading Co. in 2004: $99.48 billion (£74.27bn)

13. AT&T & Time Warner in 2019: $100 billion (£78.5bn)

AT&T's merger with Time Warner has been a long time coming, following a fight with the Department of Justice to declare it legal. Finally, in 2018 the paid-TV provider was given the all-clear to buy up the media company which owns HBO and the Warner Bros film studio. But the $100 billion (£78.5bn) deal isn't without risk, as the purchase leaves AT&T with what one analyst described as a "terrifying" debt. Perhaps WarnerMedia's CEO John Stankey (pictured), who previously headed up strategy for AT&T, will weather the storm, as this isn't the first mega-merger for the company. It hooked up with the BellSouth Corporation for $73 billion (£54.70bn) in 2006.

12. Comcast Corporation & AT&T Broadband in 2001: $101.92 billion (£76.09bn)

11. Heinz & Kraft in 2015: $105.71 billion (£79.19bn)

10. Glaxo Wellcome & SmithKline Beecham in 2000: $110.58 billion (£82.56bn)

9. Citicorp & Travelers Group in 1998: $112.21 (£84.26bn)

8. RFS Holdings & ABN Amro in 2007: $118.42 billion (£88.71bn)

7. Exxon & Mobil in 1998: $118.66 billion (£88.89bn)

The $77.2 billion (£57.83bn) merger of energy titans Exxon and Mobil in 1998 created the world's largest corporate entity and reunited the two key pieces of John D. Rockefeller's Standard Oil, which was broken up in 1911 following a notable anti-trust case.

Then and now: America's oldest companies that are still open for business

6. Anheuser-Busch InBev & SAB Miller in 2015: $137.42 billion (£102.94bn)

5. Dow Chemical & DuPont in 2015: $137.42 billion (£102.94bn)

4. Verizon Communications & Verizon Wireless in 2013: $139.82 billion (£104.74bn)

3. Pfizer & Warner-Lambert in 1999: $168.13 billion (£125.95bn)

2. AOL & Time Warner in 2000: $240.07 billion (£179.84bn)

1. Vodafone Group & Mannesmann in 1999: $303.78 billion (£227.57bn)

Eclipsing all other deals, the most humongous merger of all time was UK telecoms firm Vodafone Group's hostile acquisition of the German mobile provider Mannesmann in 1999. The British company parted with a total of $202 billion (£151.31bn) to snag its continental rival.

Comments

Be the first to comment

Do you want to comment on this article? You need to be signed in for this feature